Data Tool Shows Pandemic’s Impact on Power Prices

A clean energy valuation and risk analytics company said that low demand for energy during the COVID-19 pandemic, along with low prices for natural gas and strong power generation from renewable energy resources, has brought unprecedented low prices for electricity in multiple U.S. markets.

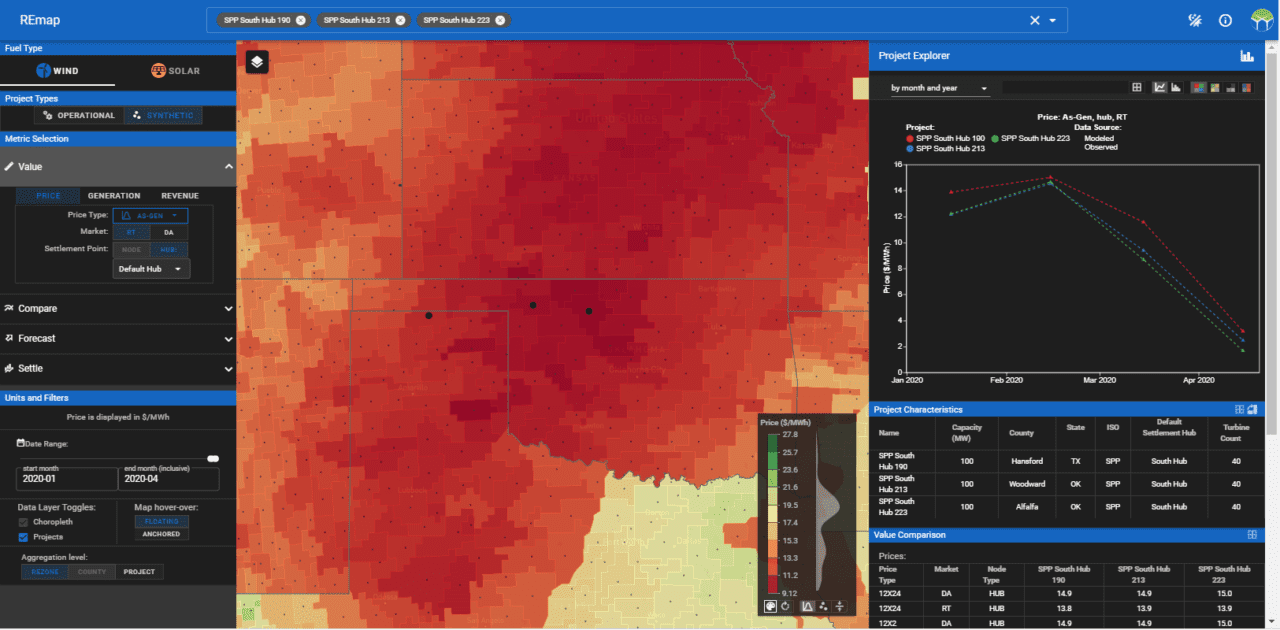

REsurety said its Renewable Energy Market Analytics Platform (REmap) shows that the production-weighted wholesale price of electricity for wind projects fell to all-time lows in recent weeks and months across markets including the Southwest Power Pool (SPP), PJM Interconnection, and the Midcontinent Independent System Operator (MISO). The company said production-weighted prices dropped below $2 per MWh in areas with a high penetration of wind power, such as Oklahoma.

REsurety, which publicly announced the launch of its REmap database on May 28, said the tool integrates weather and power market data on a large scale. The system calculates hourly financial performance for 15,000 operational and greenfield locations. REsurety, founded in 2012, has long used the data to provide the company’s clients with information to make decisions about renewable energy projects.

REsurety CEO Lee Taylor told POWER the company is “expanding the access to our secret sauce.” Taylor said REsurety for years has used its proprietary database and analytics to support the analysis of hedging instruments around renewable power projects. The public release makes that insight available by subscription to support a broader set of use cases, including greenfield prospecting, mergers and acquisitions diligence, and offtake and hedge analysis.

Global Power Demand Declines

The International Energy Agency (IEA) in its recent Global Energy Review 2020 said worldwide demand for energy declined by 3.8% over the first quarter of 2020 due to lockdowns related to the coronavirus pandemic. The agency said demand this year could fall by as much as 6% compared to 2019 levels.

Much of that drop is attributed to the closure of schools, offices, and industrial facilities, as residential demand for power rises with people working from home. Sense, a Cambridge, Massachusetts-based company whose products measure and analyze home electricity use, last week released a report that said average home electrical usage since the COVID-19 pandemic was declared in the U.S. jumped 22% from the similar March-April period in 2019.

The company, whose investors include Schneider Electric and Landis + Gyr, said residential electricity demand typically falls in March and April as warmer spring weather arrives, but the opposite occurred this year with most people under stay-at-home orders. The company noted that electricity costs are likely to rise this summer if most people are still at home, due to the need to use air conditioning for cooling, which drives summer power demand.

Sense analyzed data for 5,000 homes, each with a Sense Home Energy Monitor, across 30 states. Sense noted that mid-day demand for electricity typically falls, because people would normally be at work and school, but the pandemic reversed that, with higher energy usage beginning as early as 5 a.m. and peaking at 4 p.m., then falling into the night.

Taylor told POWER the pandemic has heightened the volatility of power markets as demand patterns have changed, as noted in the Sense data. He said REmap, a software-as-a-service (SaaS) tool, provides transparency and insight into clean energy markets, and the system’s public release today illustrates how the coronavirus pandemic has impacted renewable projects and driven record-setting low prices for power.

“Clean energy markets are going through a revolution,” Taylor said, noting that state and local mandates for renewable energy mean more projects are being evaluated, even as the pandemic has disrupted the equipment supply chains. “The scale and complexity of risks facing clean energy projects and their offtakers are at an all-time high. Understanding and managing those risks requires a step change in information, and that’s why we built REmap.”

The IEA, even as it forecasts a drop in overall demand for power, said demand for renewable energy is expected to increase as more countries support and mandate the use of clean energy resources such as solar, wind, and hydropower. The drop in demand also has further exacerbated the economic conditions that have dogged fossil fuel-backed power generation.

Fatih Birol, executive director of the IEA, said, “The recent drop in electricity demand fast-forwarded some power systems 10 years into the future, suddenly giving them levels of wind and solar power they wouldn’t have had otherwise without another decade of investment in renewables.”

The IEA in its recent report said the pandemic will trigger a $400 billion drop—about a 20% contraction—in global energy spending this year. It had forecast a 2% year-over-year increase prior to the coronavirus pandemic.

The IEA said COVID-19 would “hurt but not halt” the deployment of renewable energy projects, saying investment in renewables is “more resilient” than in other energy sectors, and will take a larger share of energy spending this year.

Science, Modeling, and Data

Renewable energy investors are looking for ways to use data to inform their decisions, a reason REsurety is moving the REmap tool into the public domain. The system works by integrating atmospheric science, power market modeling, and big data. Billions of data points from many sources are collected, cleansed, and analyzed to provide financial metrics for project developers, hedge providers, commercial and industrial buyers, and advisors, to determine the best sites for renewable projects and to stay abreast of their operational performance.

“REmap is a sea change in the access to quantity and quality of data,” said Joan Hutchinson, managing director of Marathon Capital, an early REmap client. “It has assisted Marathon in providing our clients with data-driven insights and solutions efficiently—even before project data is shared.”

Jim Howell, CEO of Birch Infrastructure, another REmap client, said, “Identifying the optimal location to invest in renewables has always been somewhat of a dark art, relying on intuition and point-specific analyses. REmap gives us the information we need to truly optimize our procurement and hedging activities.”

Taylor, who began REsurety to commercialize research he did at Dartmouth’s Tuck School of Business, said, “The clean energy economy is entering a new era. The widespread success of wind and solar development and the shift toward financial and sustainability-driven procurement has resulted in a step change in the complexity of evaluating the value and risk associated with clean energy assets and contracts. Making good decisions in this new era requires an unprecedented breadth and depth of information.”

Taylor noted that power prices “vary dramatically hour-by-hour, and so depending on when your project produces power, your production-weighted price can differ dramatically from the average price.”

The below chart provides a simple illustration using a three-hour time period. In this example, the simple average value of power is ~$9 where the production weighted value is ~$2, for a >70% discount. This simple example looks a lot like SPP South’s actual performance in April: Low prices overall, but particularly low prices (even negative at times) when it was windy and generation was high. Very low prices during high wind hours drag down the production-weighted price, which reflects when the power was produced, much faster than it does the simple average price (see example below).

| Generation (MWh) | Power Price ($/MWh) |

| 50 | $12.00 |

| 100 | -$4.00 |

| 10 | $20.00 |

| Average (aka “Around the Clock”) | $9.33 |

| Production-Weighted Average | $2.50 |

| % Discount: | -73% |

‘Highly Volatile Financial Asset’

“When you agree to buy the power from a wind farm, you buy a highly volatile financial asset,” said Taylor. “And I think most buyers are unpleasantly surprised with quite how volatile it is. And so what we are realizing is a lot of groups that had, you know, a financial model built in Excel that someone said, ‘Well, a forward curve for electricity prices just goes up over time. This is a great deal for you. You’re going green and likely making money.’

“In reality, those projects that are actually settling now are losing money, and a lot of it,” Taylor said. “And so, that’s where those parties are coming and saying, ‘Look, this was important to our sustainability goals, but our CFO can’t have … a significant loss related to what is effectively speculative betting on electricity and weather markets impacting our earnings.’ And so … they’re looking for solutions to continue to support the renewables industry while shedding risk.”

Some analysts predict overall investment in renewable energy will fall this year due to the pandemic, as projects are delayed due to supply chain disruptions, and uncertainty about economic conditions continues.

“In a lot of ways renewables are being dragged into sort of the deep end of the power and energy markets [where] they’ve been a protected class for some time, right?,” said Taylor. “So because of state renewable portfolio standards, there’s been an obligation for utilities to buy power and they do so at the bus bar, meaning you don’t have to face congestion, and they do so for a long period of time at a fixed price. So once you’ve signed that contract, no matter how much power you produce or when you produce it, you have a pretty clear known revenue.

“Those days are ending. It’s now a minority of contracts that have that. And you know, the power markets, the renewables markets are being forced to act much more like a natural gas plant or a coal plant, that has to look at the basket of risks that they face, understand them, and manage them, you know, all together … and the information needed to support that.”

—Darrell Proctor is associate editor for POWER (@DarrellProctor1, @POWERmagazine).